WAys to give IFAs back the time to build better client relationships.

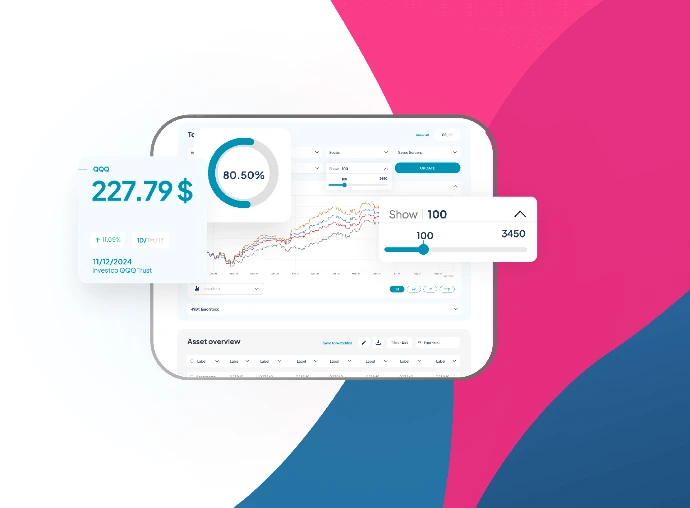

We believe that investment research shouldn't steal you away from the clients you're researching for. We’ll transform hours of complexity into minutes of clarity, so you can focus on what technology can't replicate. Understanding clients and building trust.

The problems we're solving

Why we exist

Yet, here's the reality, comprehensive research demands hours spent gathering data, cross-referencing performance metrics & tracking global markets. Hours that steal you away from the very clients you're researching for. .

How We're Different

Our Approach

strain on you maximising the opportunities.

Empathy First

Simplification, Not Complication

Partnership, not Transaction

What drives us

Our Values

Empathy first

Because we understand the weight IFAs carry, we build solutions that genuinely reduce stress, not just claim efficiency.

Time is sacred

We recognise that time is your most precious resource. Every minute we save must be genuinely valuable, not just marketed as such.

Human expertise above all

Integrity in Every Insight

Relentless Simplification

Partnership not transaction

What we're committed to

Our commitments to IFAs

We commit to:

- Provide rigorous, transparent analysis that you can trust.

- Never trying to replace your judgement, only amplifying it.

- Being honest about what we can & can’t do.

- Partnering in your long-term success.

- Listening more than we pitch.

Our commitments to your clients

We commit to:

- Supporting thorough research that leads to more reliable recommendations.

- Contributing to a more sustainable advisory profession.

- Never encouraging speed over thoughtfulness.

To our investors

We commit to:

- Maintaining financial discipline whilst pursuing growth.

- Communicating transparently about progress and challenges.

- Creating enduring value through genuine adviser success.

To our team

We commit to:

- Providing meaningful work that genuinely improves lives.

- Valuing sustainable work practices.

- Creating opportunities for growth.

- Making decisions transparently.

- Building for long-term impact.

The Impact we're having

12 Hours

Average weekly time saved per adviser.

23% AUM Growth

Average year-over-year growth among active users.

98% Retention

2.6M Hours

Meet The Team

Dedicated professionals ensuring your financial success

Tony Fred

Chief Executive Officer

Founder and chief visionary, Tony is the driving force behind our institution. He is deeply involved in developing financial strategies, marketing, and enhancing customer experiences.

Mich Stark

Chief Financial Officer

Mich thrives on challenges. With years of experience as a Financial Director, Mich has been instrumental in shaping our financial strategies. He is recognised as one of the leading experts in the field.

Aline Turner

Chief Financial Officer

Jane is a passionate financial advisor who loves helping clients navigate their financial journeys. With over a decade of experience, she has empowered countless individuals to achieve their financial aspirations.

Iris Joe

Chief Financial Officer

Iris, with her extensive background in finance, helps us interpret complex data and improve our financial strategies. She is committed to driving success and utilises her expertise to elevate our services.

Join us